4 reasons to use consolidated views in Sharesight

As a sophisticated investor, you likely have multiple portfolios. This can make it difficult to track your performance and make informed investment decisions. By using Sharesight’s consolidated views feature, you can consolidate all of your portfolios into one single view, making it easy to see your overall performance and identify areas for improvement. Keep reading for more information on the consolidated views feature and how you could benefit from using it in your Sharesight portfolio.

1. Get a comprehensive overview of your investments

The consolidated view provides a comprehensive overview of your investment portfolio, including all your holdings, transactions and performance metrics. This allows you to see your overall investment performance and make more informed decisions.

For example, if you have a setup whereby your spouse and kids all have Sharesight portfolios and have shared their portfolios with you, or if you have set up their portfolios as different entities, you can consolidate all the holdings across these portfolios into a single view – which is the consolidated view for your family.

A snapshot of a consolidated view of three portfolios in Sharesight. To create a consolidated view, simply click into your portfolio’s dropdown menu on the top right-hand side of the page and select ‘Create consolidated view’.

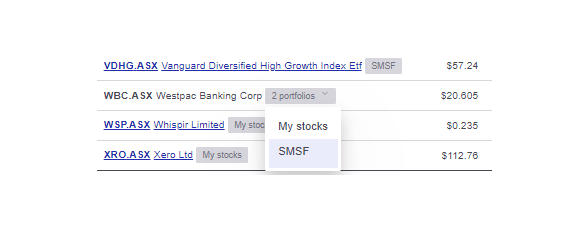

If the same asset is held across multiple portfolios, you may also want to toggle on ‘Combining Holdings by Code’ (located above the graph on your Overview page) to condense them into one line item on the Overview page of your consolidated view.

2. Better insights

By consolidating your portfolios, you can gain better insights into your overall investment strategy. This is because it allows you to clearly see which investments are performing well and which are underperforming, and make adjustments accordingly.

Once you have created a consolidated view, you can use the following reports to drill into the performance of the consolidated portfolio:

- Performance report: This report shows the total return, annualised return and relative performance of each portfolio.

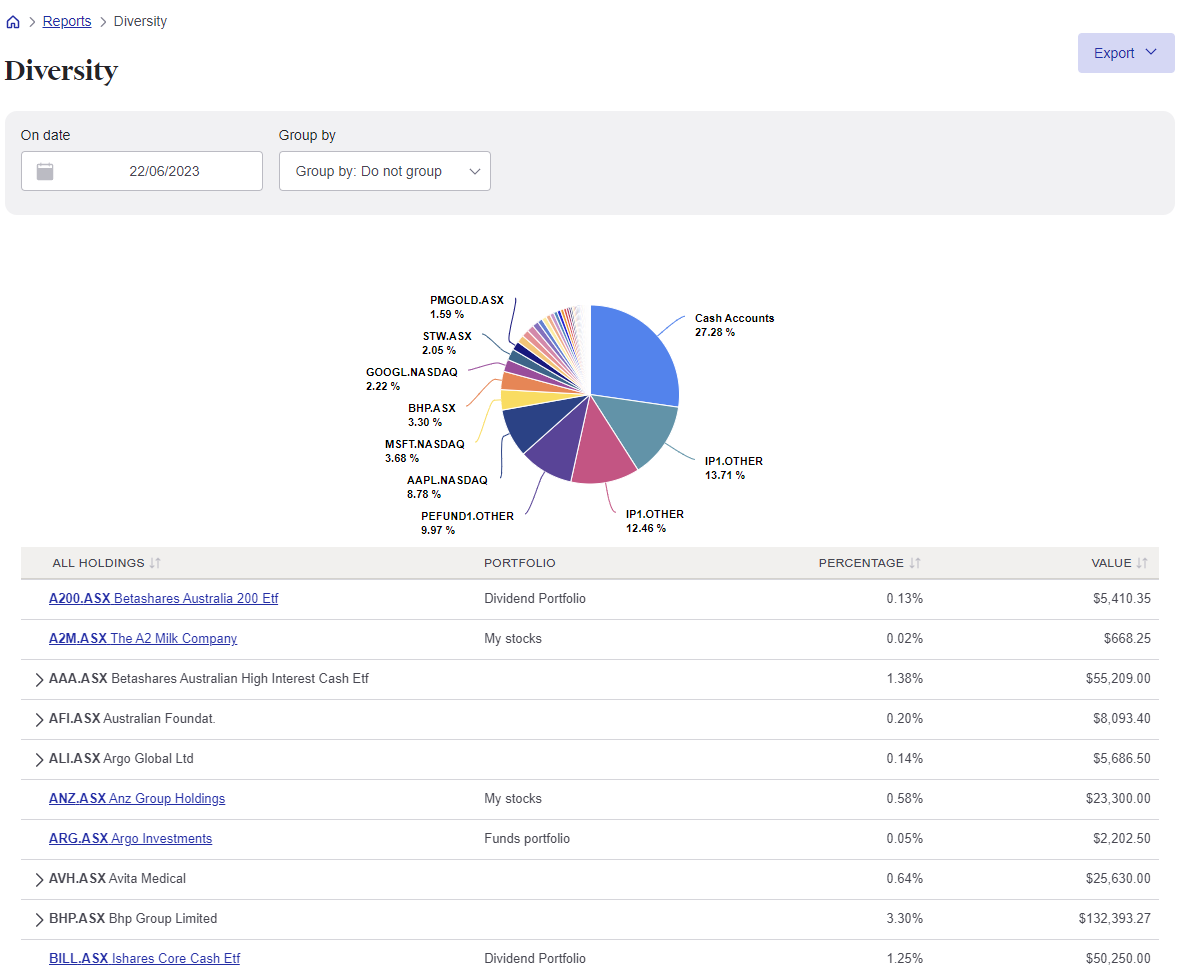

- Diversity report: This report shows how diversified the consolidated portfolio is.

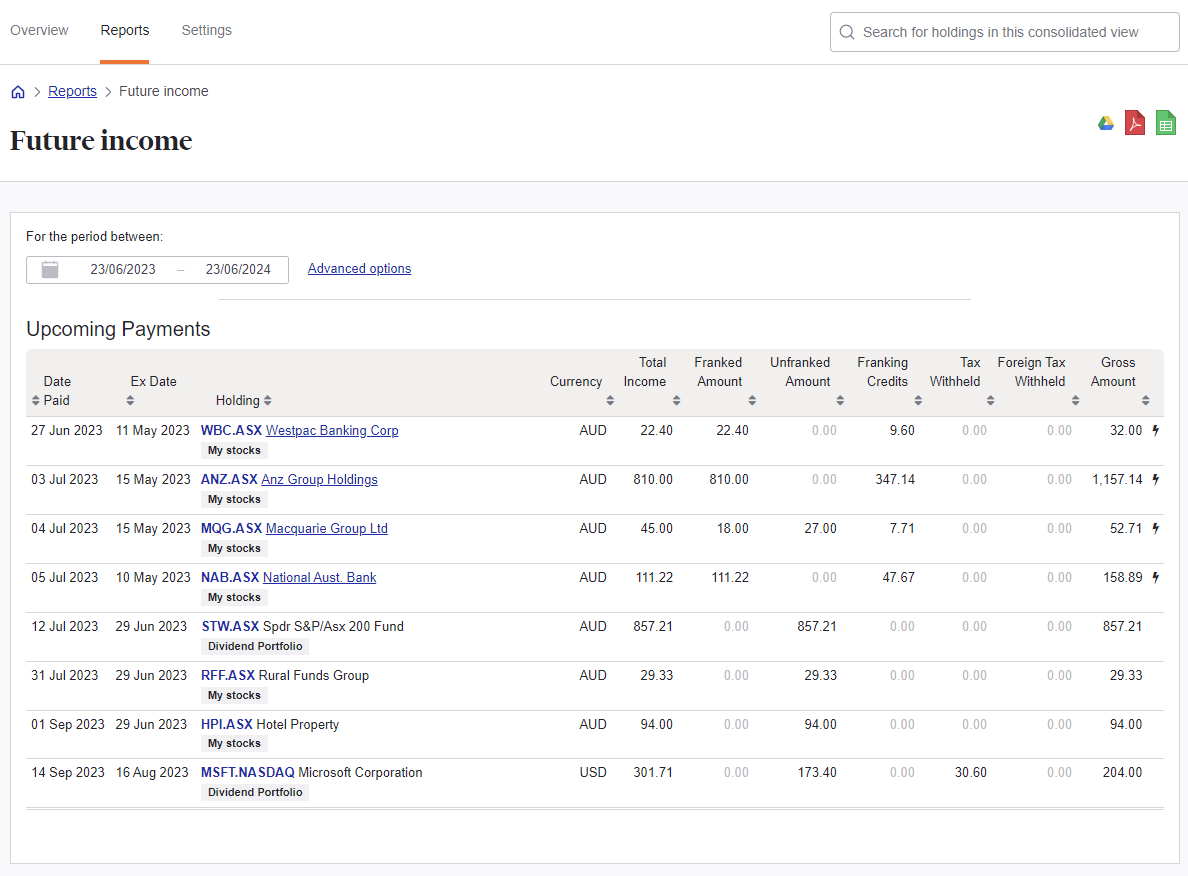

- Future income report: This report shows all the upcoming (declared) dividends across your portfolio. Or alternatively, if you want to calculate your dividend income across your consolidated portfolio, you can use it to look back over any date range to see a summary of your dividend income.

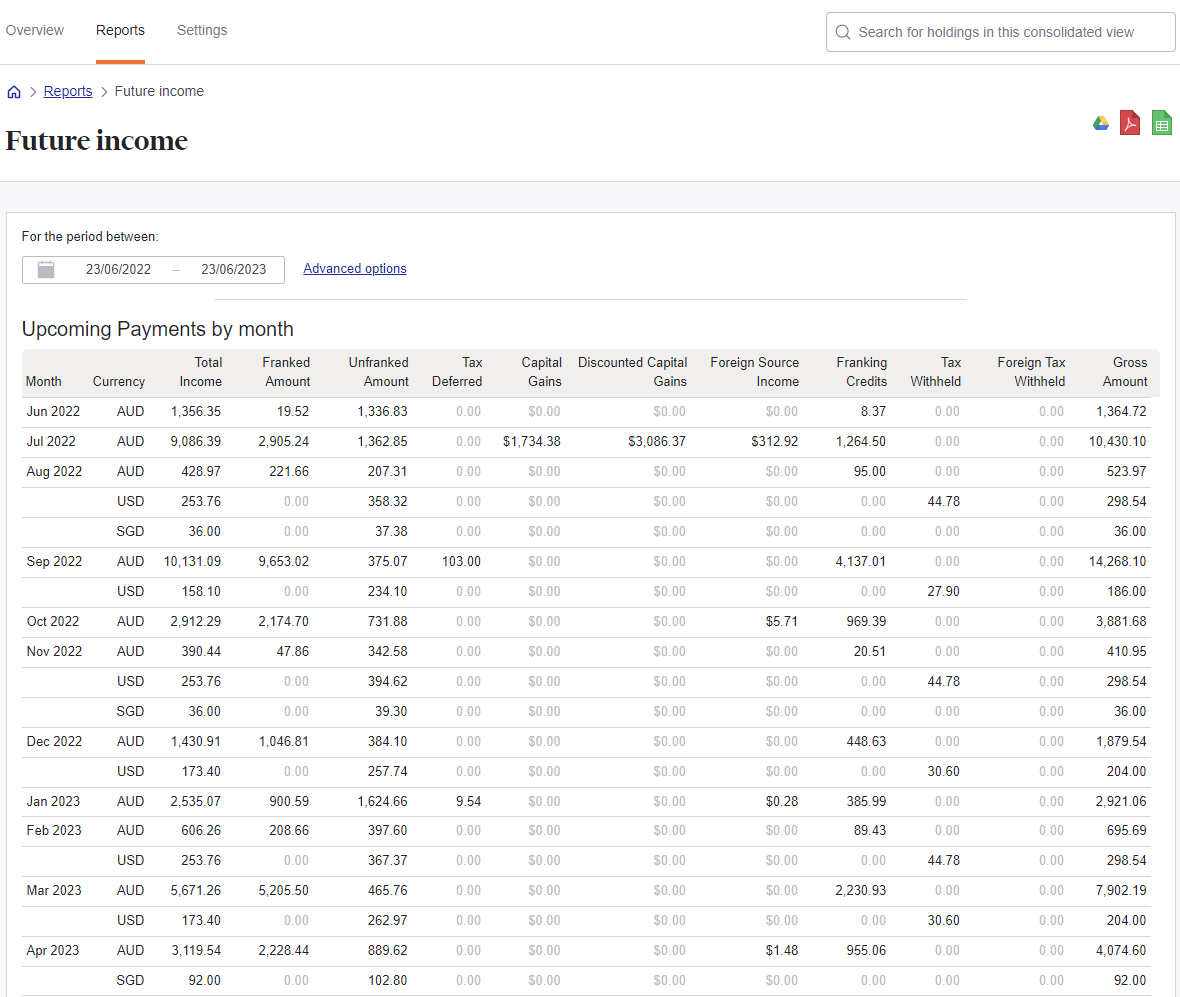

An example of the future income report being used to see upcoming announced dividends for a consolidated portfolio.

Sharesight’s tax reports are not available on a consolidated view, however it is possible to use the future income report on a consolidated view and track your dividend income during any past period of your choice.

3. Benchmark one portfolio against one another

As an investor, you might have an idea of an ideal or a model portfolio in mind. By adding this portfolio to your consolidated view, you can use this portfolio as a "benchmark", comparing and contrasting the performance between different portfolios.

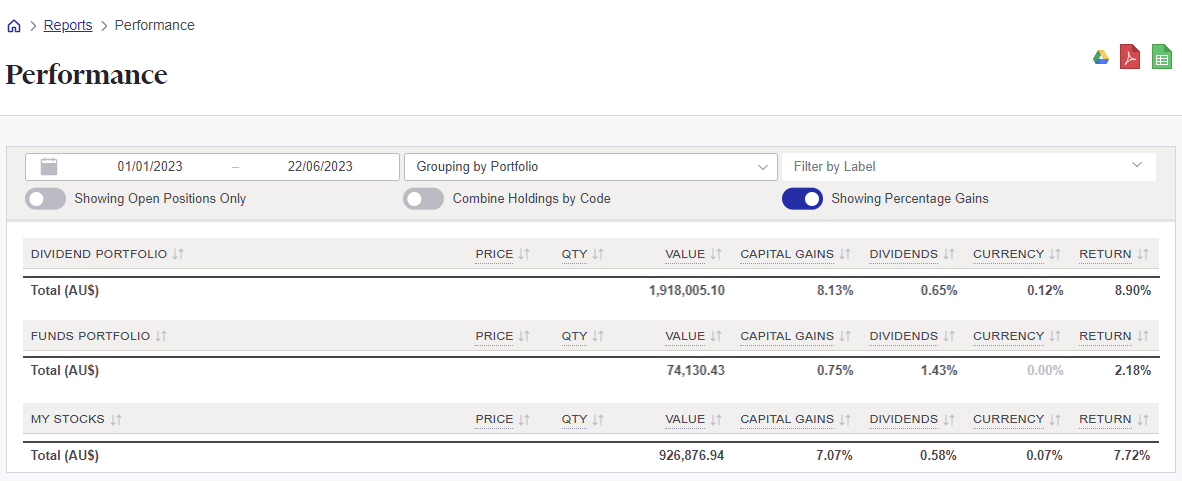

A redacted image comparing three portfolios with the performance report. To "benchmark" portfolios against each other, simply run the performance report and select “Grouping by Portfolio” in the dropdown menu at the top of the report.

4. Save time

Consolidated views can save you time by eliminating the need to toggle through to multiple portfolios to view your portfolio performance. This is especially helpful if you have a large number of portfolios.

Things to note about consolidated views

-

You can only consolidate portfolios that are in the same tax residency.

-

When you use the "Combining Holdings by Code", the link to the holdings is greyed out and you can access the individual holding via the dropdown next to it.

Track all your investments in one place with Sharesight

Thousands of investors worldwide are using Sharesight to track the performance of their investments across asset classes, markets, currencies and brokers.

If you’re not already using Sharesight, what are you waiting for? Sign up for Sharesight so you can:

-

Track all your investments in one place, including stocks in over 40 major global markets, mutual/managed funds, property, and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation and future income (upcoming dividends)

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account to start tracking your performance (and tax) today!

FURTHER READING

4 ways to prepare your investment portfolio for retirement

In this blog, we discuss retirement planning for investors, including four important factors every investor must consider.

Evaluate your investment returns with the performance report

One of Sharesight’s most popular reports, the performance report gives you the full picture of your portfolio’s returns over any chosen period.

Sharesight product updates – May 2024

This month's focus was on expanding our broker support and streamlining the customer onboarding journey, as well as additional reporting and holding functions.